London | Thistle London Marble Arch | 20.11.2025

Bryanston St, London W1H 7EH, United Kingdom

Europe’s most dynamic event dedicated to the future of private credit

Private Credit Day Europe

London November 20, 2025

Private Day Credit Europe 2025 on November 20 in London.

Private Credit Day Europe isn’t about recycled talking points or perfect-case studies — it’s where Europe’s private credit leaders have real conversations. As banks de-risk, sponsors stall, and refinancing pressures build, the market is shifting. From LBO restructurings to asset-based structures, from secondaries to sponsorless lending, this summit tackles the complexity beneath the headlines. Join a room of sharp operators, legal minds, and allocators ready to debate what’s working, what’s breaking, and where capital is truly flowing. No noise. Just the trends, structures, and strategies shaping tomorrow’s dealmaking.

Europe’s most dynamic event dedicated to the future of private credit.

Private Credit Day Europe isn’t about recycled talking points or perfect-case studies — it’s where sharp operators, legal minds, and capital allocators have real conversations. As banks de-risk, sponsors hesitate, and refinancing pressures mount, the market is entering a critical transition.

From LBO restructurings to asset-based finance, secondaries to sponsorless lending — we go beyond the headlines to examine the strategies, structures, and sectors reshaping private credit in Europe.

Key Themes

Lenders Becoming Owners

Mastering post-restructuring value creation and strategic turnaround planning.

Sponsorless Deals

Navigating new risks, protections, and evolving documentation standards.

Country Deep-Dives

Focused insights on key markets: UK, Germany, France, Italy, and Ireland.

ABF on the Rise

The return of collateral-backed deals and cross-border asset-based finance.

Opportunistic Credit

Separating signal from noise in a shifting credit opportunity landscape.

-

🎟️ Delegate Pass: €1,499

→ Full access to all sessions and networking -

🎟️ LP & Borrower Pass: €499

→ Qualified access pass to all sessions and networking

Why Attend

Cutting-edge panels on market shifts, legal frameworks, and credit innovation

Exclusive networking with senior fund managers, institutional investors, and legal experts

Insights across Europe — from macro risk to micro-structuring

Sponsor & LP-friendly with tailored content and approved passes

Agenda Highlights:

Restructuring in Action – From lender to owner

The Rise of the Unsponsored Deal – New rules, new risks

UK, Germany, France, Italy Deep Dives – Credit trends by region

Collateral is Back – ABF’s resurgence and legal implications

Opportunistic Credit – Strategies in special sits and off-the-run deals

🔗 Sponsor Opportunities

Stage presence, website branding, and on-site visibility

Engage face-to-face with top-tier GPs, LPs, and advisors

Maximize exposure with social media spotlights and delegate touchpoints

Private Credit Day Europe 2025 Sponsorship Inquiry

contact@ddtalks.com

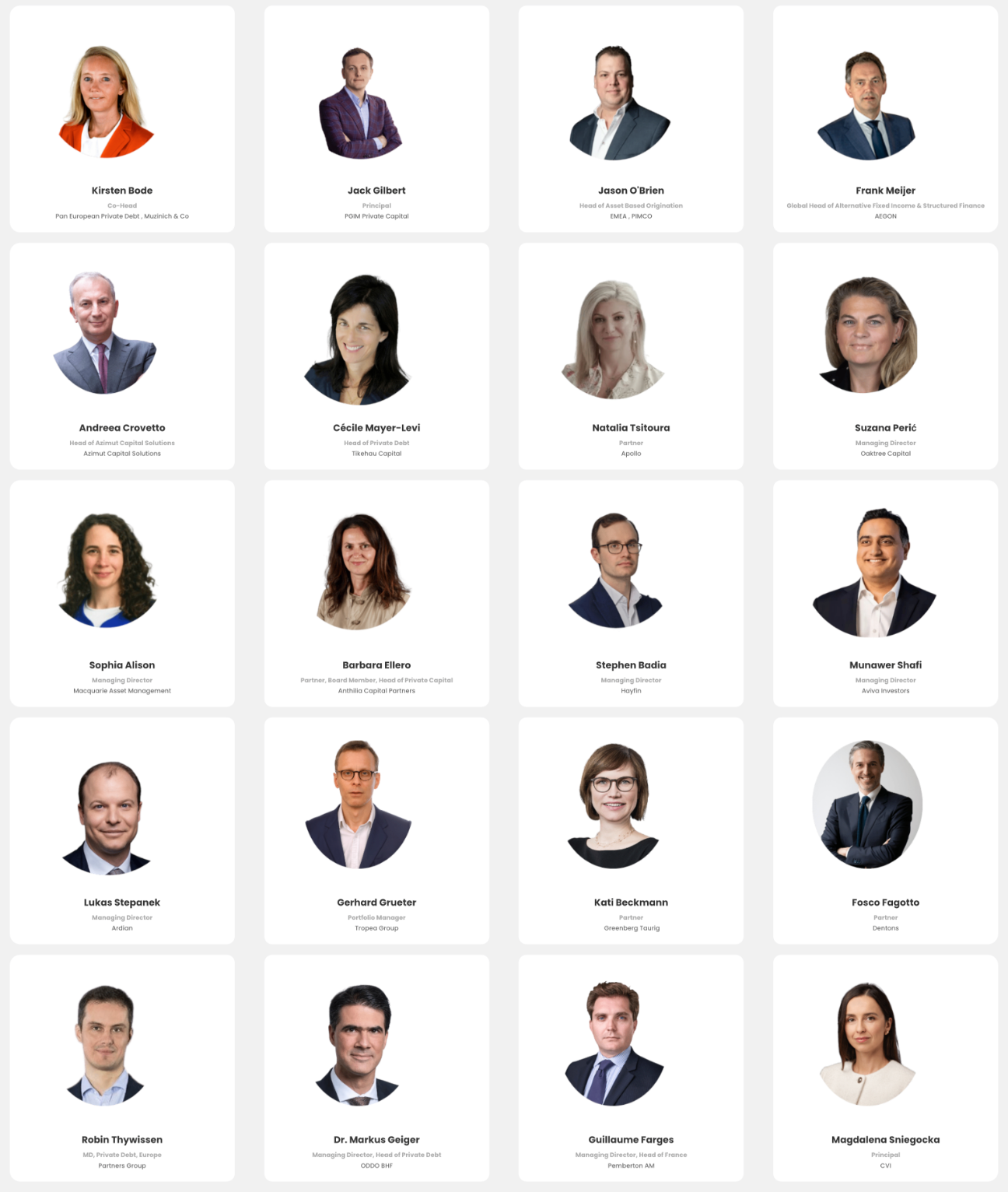

Speakers Include

Kirsten Bode

Co-Head

Pan European Private Debt , Muzinich & Co

Jack Gilbert

Principal

PGIM Private Capital

Jason O'Brien

Head of Asset Based Origination

EMEA , PIMCO

Frank Meijer

Global Head of Alternative Fixed Income & Structured Finance

AEGON

Andreea Crovetto

Head of Azimut Capital Solutions

Azimut Capital Solutions

Cécile Mayer-Levi

Head of Private Debt

Tikehau Capital

Natalia Tsitoura

Partner

Apollo

Suzana Perić

Managing Director

Oaktree Capital

Sophia Alison

Managing Director

Macquarie Asset Management

Barbara Ellero

Partner, Board Member, Head of Private Capital

Anthilia Capital Partners

Stephen Badia

Managing Director

Hayfin

Munawer Shafi

Managing Director

Aviva Investors

Lukas Stepanek

Managing Director

Ardian

Gerhard Grueter

Portfolio Manager

Tropea Group

Kati Beckmann

Partner

Greenberg Taurig

Fosco Fagotto

Partner

Dentons

Robin Thywissen

MD, Private Debt, Europe

Partners Group

Dr. Markus Geiger

Managing Director, Head of Private Debt

ODDO BHF

Guillaume Farges

Managing Director, Head of France

Pemberton AM

Magdalena Sniegocka

Principal

CVI